Active Portfolio Management Grinold Kahn Pdf Download

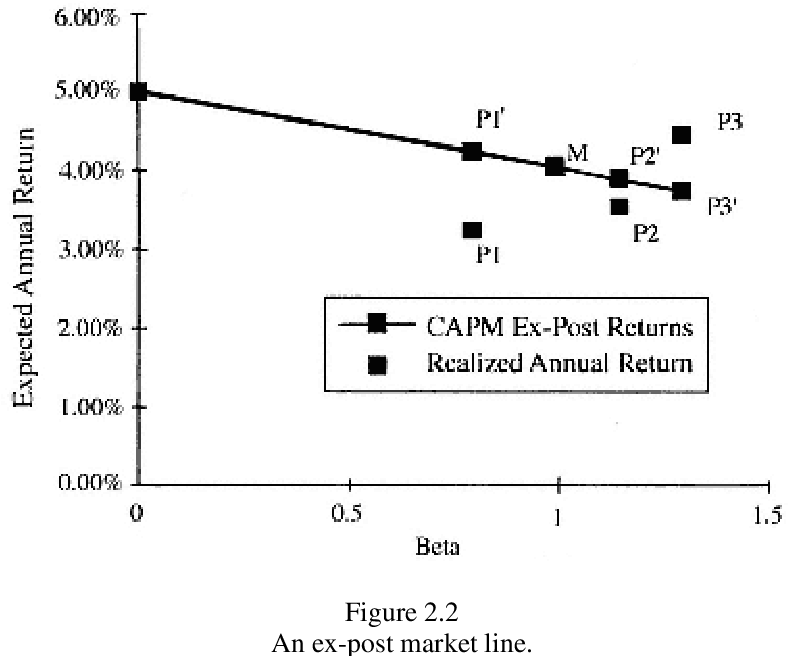

Article citationsGrinold, R. And Kahn, R.N. (2000) Active Portfolio Management: A Quantitative Approach for Producing Superior Returns and Controlling Risk. McGraw-Hill, New York.has been cited by the following article:.TITLE:AUTHORS:KEYWORDS:,JOURNAL NAME:,May26,2015ABSTRACT: Traditionally, portfolio managers have been discouraged from timing the market, for example, equity managers have been forced to adhere strictly to a benchmark with static or relatively stable components, such as the S&P 500 or the Russell 3000. This means that the portfolio’s exposures to all risk factors should mimic as closely as the corresponding exposures of the benchmark. The main risk factor, of course, is the market itself. Effectively, a long-only portfolio would be constrained to have a beta of 1.

LE456 by LePou Plugins (@KVRAudio Product Listing): LE456 is a preamp sim roughly based on a piece of famous German gear. LE456 has 2 channels and 2 modes per channel. Each channel/mode share the same features. Apart from the usual tone controls (drive, low, mid, high and contour), each channel/mode offers two different tone stacks that can be accessed via the focus switches. LePou Plugins has released a Mac version of its Le456 preamp effect plugin. The Le456 is a preamp sim roughly based on German gear. It has 2 channels and 2 modes per channel. Each channel/mode shares the same features. Apart from the usual tone controls (drive, low, mid, high and contour), each channel/mode offers two different tone stacks. LePou Plugins has announced that Le456 is now available for Mac OS X in VST and AU plug-in formats and with a brand new look for the occasion. LE456 is a freeware preamp sim roughly based on a piece of famous German gear. It has 2 channels and 2 modes per channel. Each channel/mode share the same features. Lepou's le 456 guitar amp sim updated and available for mac 2017.

More recently, however, managers have been given greater discretion to adjust their portfolio’s risk exposures (especially, the beta of their portfolio) dynamically to match the manager’s beliefs about future performance of the risk factors themselves. This freedom translates into the manager’s ability to adjust the portfolio’s beta dynamically. These strategies have come to be known as smart beta strategies. Adjusting beta dynamically amounts to attempting to “time” the market; that is, to increase exposure when one anticipates that the market will rise, and to decrease it when one anticipates that the market will fall.

May 06, 2018 ActivePortfolioManagement. My solutions to the problems in Active Portfolio Management (Second Edition) by Grinold and Kahn. There may be some errors. If you end up. Notes for Active Portfolio Management, by Grinold and Kahn - RJT1990/Active-Portfolio-Management-Notes.